I mentioned that this kind of economic prediction is very difficult to do with any accuracy -- not least because the extent to which budget spending influences votes is not only very hard to calculate, but varies from year to year and community to community.

However, for obvious reasons, the role of the budget will be greater where all other factors are evenly balanced: in other words, in marginal seats. So what I'm going to do here is say boo to accurate predictions based on this data alone. And I'm going to say a slightly quieter boo to predictions factoring in existing margins, polling, voting history, traditional voting of demographics, targeted campaign strategies, ideology and promises and the like ... for now.

What I am going to do is work out roughly how people would vote if financial benefit were the only consideration in their vote. This will assume all financial benefit is equal, so a million dollars of funding is given equal weight regardless of how directly (or indirectly) it impacts the voters. Now obviously this is not how the real world works. One million dollars towards education is fantastic (a million dollars more fantastic than nothing, at least) but it will mean less to parents than a million dollars towards disability services would mean to the disabled and their carers (even if we assume there are as many parents as disabled people and carers).

So the calculations are cheap and nasty, but that is okay because they will not be a major plank in our raft of prediction tools - simply another factor to consider in close-run seats. Besides, we're still working with 2006 data anyway, so we're going to have to live with some inaccuracies.

So here are the maps:

Firstly, here is a map of seats gaining funding between the five initiatives outlined last week: (N.B. some averaging and approximation was necessary where electoral seats did not match up with ABS statistical divisions. Generalisations have been made, and urban seats are inaccurate due to the low resolution of ABS maps.)

For this map, each sheet was shaded with pure green (#00FF00) at an opacity level equal to the number of people affected by the funding gains. The intensity of the colour, therefore, shows the percentage of people won over by the pension, school and disability increases.

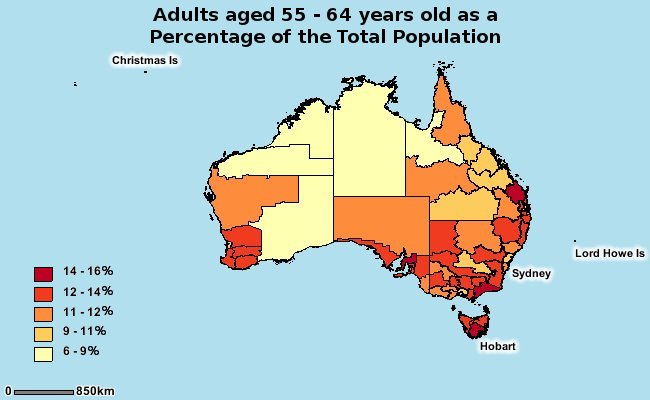

It is assumed that the benefits from the programs mentioned last week are independent of each other. In other words in an area with ~10% of the population aged 55-64 and ~5% living with a disability, the total people benefiting from the two initiatives related to these demographics is not 15% of the population but 14.5%, since .5% (10% of 5%, or 5% of 10%) fit into both categories and should not be counted twice. At first this seems illogical when we allow for a person between 55 and 64 to also vote according to the aged 4-and-under factor, but this is because people close to retirement may have children in that age bracket and act accordingly. None of the demographics are exclusive of any other - A 55 year old disabled man attending university and raising a school age child while his wife is pregnant would be rare, but would also be affected by all five budget measures.

As we can see the distribution is surprisingly even. There is a slight advantage to seats in southeastern states, but not one that is noticeable on this map.

Here is another map, showing places loosing funding:

Again, the burden is rather evenly spread. The concentration in urban areas is slightly more noticeable than the concentrations in the previous map. This is largely the result of the university cuts.

However, we need to remember that not all of this funding is equal. Different measures cost different amounts and benefit or disadvantage people to different extents. The above map demonstrates the population densities where people are aided or disadvantaged. The following map factors in how much their are aided or disadvantaged. The above map shows the government's target demographics, the one below shows the extent of the impact in average dollars per person.

Here, the intensity of the colour is relative to the amount of money gained per person on average. It is the benefit per targeted person multiplied by the proportion of people benefited. So 10% of the population gaining a $100 boost is valued here on par with 100% of the population gaining a $10 bonus. The problem with this model is that giving $5 billion to one person in Sydney is the same as giving $1000 to everyone in Sydney, although the latter will clearly get you more votes.

Here is a map where the amount of money is not a factor. votes can be bought for a fraction of a cent, and spending almost 20,000 per targeted person (e.g. the NDIS) is worth no more or less than handing out loose change on the street corner.

This makes the distinctions between winners and losers a little clearer. Again the metropolitan areas are feeling the university cuts, but over all the nation is in the green. And in practical terms this is probably a closer mirror to the thinking of people who vote according to personal benefit; they don't compare themselves to others along the lines of 'the money I got in my old age pension boost is only about 5% of what they get under the National Disability Insurance Scheme'. They merely want to know if they have more than they did before - and if the opposition will see and raise the government's promises.

The problem for the opposition is that they need to try to offer more money to more people while ensuring greater savings. Or do they?

How to Frame a Budget from the Other Side of the Floor:

The budget reply came as a big surprise to many. The opposition agreed with the bulk of Labor's proposed budget recommendations. There was none of the normal game playing, such as blaming Labor for the deficit and not supplying a surplus. Programs were not opposed simply because Labor proposed them. It was an odd day for many, however it was a fantastically well thought out move.

Firstly, in the last budget Abbott did not promise the kind of immediate return to surplus many half-interested voters assume he intends to give. The Coalition has already done the groundwork on this. If a budget surplus is your top priority, the Lib-Nats have already framed themselves as the can-do candidates. And Abbott continued this theme by calling the situation an "emergency" which required such "objectionable" measures to be adopted. However, Mr Abbott has not promised unreasonable economic changes he cannot deliver - his reply is roughly equal in pragmatism to Labor's budget because it is a very similar deal.

More importantly, by agreeing on a lot of Labor's plans, he's taken the wind out of their sails. Any backlash - even post election and even if the Liberals come to power - will be against the Gillard government reforms. And by agreeing to Labor's terms on the baby bonus, the NDIS and most of the other budget plans, these are not going to win Labor much traction because they are not going to be debated. And this is the key to Abbott's budget reply. He has chosen where the two parties will differ, and he gets to frame the debate.

The key differences, and thus the main focus of this campaign, are the "carbon tax", the "mining tax" and "Gonski reforms". Importantly, only one of those is the term that Labor originally used to describe them. It is fair to say that many people do not fully understand the Carbon Tax or the Mining Tax. They sound like taxes on the common people, and sound like big ones. In one of the post-western-Sydney-trip reports on the ABC there was a shop owner concerned about how he needs to pay the carbon tax on top of the GST, income tax and the like. This is clearly one issue where the Coalition has clearly cut through more effectively than the Government.

The odd-one-out is the Gonski reforms, which are also poorly understood and somewhat nebulous as far as the average voter understands. There is increased funding for schools, sure, but how this funding is allocated (private vs public, infrastructure vs technology vs staffing) is all very confusing to anyone who doesn't have the time to sit down and read about the policy.

I could look at which areas will benefit the most from the scrapping of the "carbon pricing", the "mineral resource rent tax" and, to a lesser extent, the "Gonski reforms". But I suspect this is irrelevant, because the Coalition is selling this as a better deal for all Australians. And perhaps it is -- that is for the voters to decide -- but my point is this: Abbott's reply was not targeted at helping specific target demographics at the expense of the other. It was an exercise in downplaying Labor's strongest policies and framing the economic debate in terms he thinks he has the best chance of winning.

This is not necessarily a bad thing, and it is not necessarily a good thing. It is just a simplicity thing. Abbott might be hiding some further, more controversial measures he plans to bring in -- to do with "stopping the boats" perhaps -- by sweeping them under the carpet. Alternatively, these could simply be the core issues of his campaign, with nothing hidden by the time we reach the polls, which is why he has no declared plans to change industrial relations until the election after next.

Mr Abbott is offering a simple, easy to grasp choice. Perhaps this is the best response when Labor has trouble explaining their own policies so that the average voter can comprehend. Better the devil you understand...